Digital Customer Onboarding Process

What is digital customer onboarding?

Digital customer onboarding is the process of using technology to streamline the customer onboarding experience. This can include using a CRM or other software to automate tasks, using digital channels to communicate with customers, and using digital forms and signatures to collect customer information. By using digital customer onboarding, businesses can improve the efficiency of their customer onboarding process, making it simpler and faster for customers to get started with their new product or service.

Through digital onboarding, the manual processes are replicated online, additionally with the benefit of automation.

Why digital customer onboarding?

Digital onboarding is more efficient, user-friendly, faster at onboarding clients, and far more accessible for everyone. In the past, onboarding new clients or customers was a time-consuming process that required in-person meetings, paper forms, and a lot of back-and-forth communication. With digital onboarding, all of that can be done online, quickly, and easily.

Let’s say for banks in the past the customers had to come to the banks to initiate any process but now their customers or clients can fill out forms and sign contracts online without having to come to the banks. Everything can be done from the comfort of their own homes or offices.

And because everything is done online, digital onboarding is also much faster than traditional methods. You can get new customers or clients signed up and ready to go in a fraction of the time it would take using old-school methods. Finally, digital onboarding is far more accessible than traditional methods. That makes it perfect for businesses with customers or clients all over the globe.

Digital customer onboarding in banking

In the banking industry, onboarding is a critical part of the customer experience. It involves taking new customers through a series of steps that a customer must complete to become fully-fledged, digitally active members of your bank. This mostly involves verification and identification processes.

For instance, compliance officers could perform manual compliance checks, digital identification checks, credit checks, and other checks to satisfy the requirements of know your customer (KYC) and anti-money laundering (AML).

When talking about customer onboarding in banking and regulatory compliance, AML and KYC are the key concepts.

Why is digital onboarding important in banking?

In an era of technological advancement, it’s more important than ever for banks to provide a smooth customer onboarding experience.

Many automated functions are enabled by digital onboarding, allowing for faster Know Your Customer (KYC), Know Your Business (KYB), and Anti-Money Laundering checks.

There are several reasons why is customer onboarding so important for banks:

1. First impressions matter: The first interaction a customer has with a bank will set the tone for their entire relationship. If the onboarding process is difficult or confusing, it will likely turn the customer off from the bank entirely.

2. Onboarding is an opportunity to build trust: Customers need to trust their bank in order to feel comfortable doing business with them. The onboarding process is an opportunity for banks to establish that trust by clearly explaining their products and services, and providing helpful and responsive customer service.

3. Onboarding can help prevent fraud: By verifying a customer’s identity and ensuring all required documentation is in order, banks can help prevent fraud before it happens. This not only protects the bank, but also the customer’s finances.

4. Good onboarding leads to repeat business: If customers have a positive experience during onboarding, they’re more likely to continue doing business with the bank down the road. Conversely, if they have a bad experience, they’re more likely to take their business elsewhere.

5. Onboarding helps build brand loyalty: A positive onboarding experience can lead to customers becoming lifelong fans of a particular bank or brand. In today’s competitive landscape, that loyalty is invaluable.

Why analyzing and optimizing your customer onboarding experience is a good idea?

One area where banks have been particularly lacking is in the area of customer onboarding.

There are a number of reasons why analyzing and optimizing your customer onboarding experience is a good idea. First, it’s an opportunity to improve the customer experience and increase satisfaction levels. Second, it can help you reduce customer churn. And third, it can lead to increased revenues and profitability.

Key features of good onboarding in banking

When it comes to online banking apps, a frictionless experience is essential.

Let’s take a look at good onboarding features:

Streamlined complex workflows:

With digital onboarding, the complex processes such as uploading documents, profile images and verification of user identity become quick and easy.

Enhanced customer experience:

Digital customer onboarding allows customers to complete the entire process online, without having to visit a branch or talk to a banker. Also, banks can use digital channels to collect important information about customers and their preferences, which can then be used to provide a more tailored experience.

Increased Efficiency:

Digital customer onboarding can help banks to speed up the overall process by automating many of the tasks involved. This includes tasks such as identity verification and document collection, which can be completed quickly and easily online.

Improved Risk Management:

Online customer onboarding allows banks to collect more comprehensive information about customers upfront, which can help to identify potential risks early on. This data can then be used to develop more effective risk management strategies.

Reduced Costs:

Digital customer onboarding is typically more cost-effective than traditional methods, such as paper-based processing or in-person meetings. By completing the process online, banks can avoid the need for costly physical infrastructure.

Increased conversion rates:

This approach makes the procedure simple enough to keep conversion rates high. When new clients go through the process smoothly, they are more likely to finish the onboarding process.

Easy integrations:

Banking needs to connect with multiple applications to perform customer operations. The platform integrates with multiple systems, including core baking systems, in order to automate KYC and product eligibility checks. To store customer data banks need database platforms, and to refund or collect payment banks need to integrate with payment gateways.

Risk assessment in customer onboarding

Risk assessment is the process of identifying, assessing, and managing the risks associated with a business or organization. The aim of this is to ensure that risks are identified, understood, assessed, and managed appropriately so that they do not impact business objectives.

Also, risk assessment is not just about identifying risks; it’s also about understanding how these risks can be mitigated.

Risk assessment is important when onboarding individuals or companies’ clients. Know Your Customer (KYC) and Anti-Money Laundering (AML) risk assessment checks assist assure compliance, preventing fraud, and giving you information about your new clients’ behaviors.

Performing KYC/AML risk assessments at onboarding

KYC/AML risk assessments are typically performed at the time of onboarding new customers, but you can also perform risk assessments on an ongoing basis if there are any changes in the customer’s activity or circumstances. This can be done by collecting information about the customer’s identity, employment, financial history, and other relevant factors. Once this information is collected, it can be used to generate a risk score for the customer. By performing these risk assessments at onboarding, you can help protect your business from fraud and other risks.

You can set up as many customized rule conditions as you want, giving you a comprehensive risk assessment that delivers a thorough summary of your client’s risk rating. This way, you’ll know how to approach the client confidently. You can adapt rules to assess clients across several branches and countries, catering to specific needs. This way, all data and risk variables are accessible to all relevant stakeholders, meaning your teams will be more informed and efficient. Paving the way for risk-based decisions with greater assurance, not only does this have the potential to maintain compliance with all relevant regulations and legislation but also maximize business efficiency for all stakeholders.

Challenges with digital onboarding in banking

Digital onboarding is the process of using technology to welcome new customers and help them get started with your product or service. It’s a key part of the customer journey, and it’s important to get it right. However, digital onboarding can be challenging.

Here are some common challenges:

1. Ensuring a consistent customer experience across channels: Customers expect a consistent experience regardless of how they interact with your brand. This can be difficult to achieve with a multi-channel customer onboarding process.

2. Creating engaging and informative content: The content you create for your digital onboarding process needs to be both engaging and informative. It should help new customers understand your product or service and how to use it.

3. Managing customer expectations: Digital onboarding can set high expectations for your product or service. If the reality doesn’t meet these expectations, it can lead to disappointment and churn.

4. Getting buy-in from all stakeholders: To create a successful digital onboarding process, you need buy-in from all stakeholders involved, including IT, marketing, and customer support.

5. Implementing the right technology: The technology you use for digital onboarding needs to be robust and scalable. It should also integrate well with other systems in your organization.

6. Making it secure: The primary risks to digital banking include unencrypted data, malware, insecure third-party services, and spoofing. Fraudsters exploit poor privacy habits to acquire login credentials and commit fraud. Weak passwords and unsecured networks are criminals’ primary targets. When accessing their platform, a bank should also help the users to authenticate them to prevent fraud.

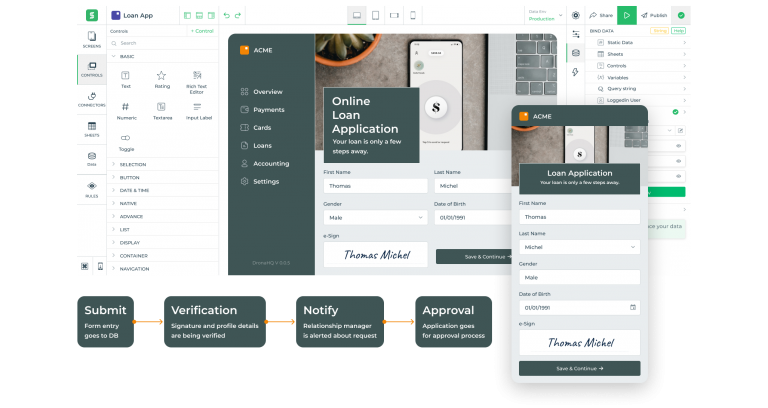

How to leverage low code to simplify digital onboarding in banking

When it comes to digital customer onboarding in banking, low code can be a powerful asset. By leveraging low-code platforms, banks can quickly and easily develop digital customer onboarding experiences that are simple and streamlined.

There are a few key ways that banks can leverage low code to simplify digital customer onboarding:

1. Use low code to develop custom forms and workflows: Low code platforms make it easy to develop custom forms and workflows for digital customer onboarding. This means that banks can tailor the onboarding experience to their specific needs and requirements.

2. Implement pre-built templates and components: Many low code platforms come with pre-built templates and components that can be used for digital interface for customer onboarding. This can help banks save time and resources when developing their onboarding process. Users can build responsive web and mobile apps that manage the consistent experience across the devices.

3. Deploy quickly and easily: Low code platforms are designed for rapid deployment. This means that banks can get their digital customer onboarding process up and running quickly and without any major headaches. By leveraging low code, banks can simplify their digital customer onboarding process and make it more efficient and effective.

4. Setup complex automation: Onboarding customers requires a lot of processes that can be automated using low code platforms. For example, document approval can be set under automation and a real-time notification can be sent to the customer or the banker.

5. Seamless integration: Low code platform offers quick integration to popular applications and databases. Users can rapidly build a custom frontend on top of third-party apps, APIs, and databases.

6. Setup rules and validations: Low code tools can help by providing rules and validation features that can make it easier for businesses to collect and validate customer data. By using these features, banks can reduce the amount of time and resources that they need to spend on onboarding customers.

7. Enterprise-grade security: With features like SSO and protecting the integrity of your data by limiting who has access to important information and controlling how users interact with your app through login authentication, email confirmation, user roles, and permissions low code tools offer better security.

Benefits with low code

Low-code platforms provide a number of advantages that can improve customer experiences, including:

User-friendly interface: Low-code platforms provide drag and drop interface that makes it easy for businesses to create digital customer onboarding processes without the need for complex coding.

Reduced time to market: Low-code platforms allow businesses to quickly create and deploy digital customer onboarding processes. This can help businesses save time and money by reducing the time it takes to develop and deploy these processes.

Reduce onboarding costs: Users can reduce manual data entry with low code by integrating with external applications seamlessly and securely.

Mitigate risks: Low code can also help reduce the risk of missed deadlines by automating tasks and providing a clear roadmap of what needs to be done.

Eliminate manual work: Many organizations still rely on manual, paper-based processes that are time-consuming and often result in errors. By automating manual tasks and processes, low code can help eliminate errors and speed up customer onboarding.

Accelerated time to revenue – Low code accelerates time-to-revenue by allowing you to quickly launch new customer onboarding processes. Low code also provides the flexibility to easily change and update your process as needed.

How DronaHQ can help you build a digital customer onboarding process

Technology advances quickly, and new tools are created every day to make our lives easier. It is imperative for financial institutions to be aware of those rapid changes and ready to adapt so they can provide the best customer experience for every customer. In spite of all that has changed, one thing remains the same: the customer experience is essential, and customer satisfaction comes first.

The importance of digital tools to help improve the business as well as understanding what needs to be done is also crucial. Now is the time to examine your company, review what needs to be changed, and figure out how to engage with your customers the most creatively and improve their experience at every step.

Naturally, when developing your digital onboarding experience, time to market, scalability, and costs will be key factors in determining the length of this process and which capabilities are included. However, with the right low-code platform and skillset, companies can develop an effective digital onboarding process that meets their needs at a price that is reasonable for them.

Low code tools like DronaHQ are effective solutions for building a customer onboarding process in banking. This approach allows developers to quickly and easily create digital processes that are tailored to their organization’s specific needs.

With DronaHQ you can:

Accelerate the development process

DronaHQ offers 100+ responsive, reusable, powerful out-of-the-box UI components enabling building interfaces in a straightforward and quick manner. With its easy to use drag & drop interface users can also create minimal viable products (MVPs) rapidly and reduce the length of the process from over 3 days to under 3 hours.

Configure seamless integrations

Manage data retrieval with easy integrations. Connect to any API, databases like MongoDB, PostgreSQL, MySQL, and more, and third-party applications within a few clicks. Users can also view data from multiple data sources in a single view.

Define user-based permissions & access controls

Organizations may simply implement RBAC at all levels of data sources, screens, or even individual components with the help of DronaHQ. Based on their user credentials and roles, owners can configure permissions for end users. This can help your business avoid unneeded security risks and safeguard data integrity.

Get enterprise-grade security

DronaHQ is SOC-II and ISO 27001 certified, and all plans include SSL encryption to keep your data safe. Also with a secure embedding, only logged-in or authorized users can access the app.

Sign up now to start your exciting digital customer onboarding journey.